I am a new member to the group and am so delighted to find group insurance. I have contacted Mon so let's see what happens.

GT Rider Motorcycle / Health Insurance

- Thread starter DavidFL

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I am a new member to the group and am so delighted to find group insurance. I have contacted Mon so let's see what happens.

The group insurance is good value & easy to join. You can join anytime.

Mon will look after you.

Nathamon Somsri [email protected]

email cnx insure. Address 2 posts above this one.David where can I get details about the insurance like what it covers and cost. Thanks!

He will reply promptly

This insurance is only for up to 60 years old?? Unfortunately I am already 70 so it doesn't apply to me.

Hello David, I entually got my health insurance trough this group. I feel its good value for what you get so I want to thank you for all the work you do on behalf of the members setting this up...ColinThe group insurance is good value & easy to join. You can join anytime.

Mon will look after you.

Nathamon Somsri [email protected]

Hello David, I entually got my health insurance trough this group. I feel its good value for what you get so I want to thank you for all the work you do on behalf of the members setting this up...Colin

Welcome. We've got look after each other & help out when we can.

Mon @ Cnx Insure is a gem of a lady, plus rides a bike as well. One of us. She can fix most insurance issues if you ask.

[email protected]

A quick update. The GTR Group Health Insurance works for re-entry into Thailand, where they currently require covid-19 insurance coverage to enter the country.

I will post a copy of the coverage certificate once I get mine in a few days.

I will post a copy of the coverage certificate once I get mine in a few days.

A quick update. The GTR Group Health Insurance works for re-entry into Thailand, where they currently require covid-19 insurance coverage to enter the country.

I will post a copy of the coverage certificate once I get mine in a few days.

How long time to make one and shipped?

I asked [email protected] several days ago, said I was in no rush, & got the PDF file today.

As long as it has the validity date, with the details of the policy & your name it should be good until the policy is up for renewal again.

Big Bike Insurance

Working my way through the aftermath of the accident - insurance, bills and recovery.

www.gt-rider.com

www.gt-rider.com

The 3rd party bike insurance I had with Thai Sri covered me for 200,000 baht damages to the other vehicle.

Negotiations were completed today at the CK police station & Thai Sri has agreed to pay out. The final definitive cost has yet to be decide, but is hovering on 200,000 baht. Anymore than this and it is my bill.

So time for a bike insurance upgrade I thought.

With the most options & very competitve prices, the Roojai broker would seem to be the way to go.

www.roojai.com

www.roojai.com

Compulsory Motorcycle Insurance in Thailand

Compulsory Motorcycle Insurance, also known as “Por Ror Bor” is mandatory insurance required by law for all motor vehicles within Thailand. This is to provide insurance coverage for everyone affected by motorcycle accidents, regardless of whether the person is a driver, a passenger, or a pedestrian. In the cases that involve a loss of life or body parts or health damage including the deceased person’s heir will also be covered, in the case of death.

Basic Por Ror Bor Insurance coverage

If there is an accident, the driver can claim compensation if injured, but will not cover the motorcycle damage. The details are as followings:

Death, loss of vital organ, and permanent disability = up to ฿35,000

Medical expenses = up to ฿30,000

Coverage by which the driver is not at fault

Compensation can be claimed as following details:

Death and permanent disability = up to ฿300,000

Medical expenses = up to ฿80,000

Daily compensation = ฿200 per day (up to 20 days) up to ฿4,000

Loss of 2 body parts = ฿300,000 / loss of 1 body part = ฿250,000 / loss of a finger or more = ฿200,000

To upgrade, these are the options.

Voluntary Motorcycle Insurance

Voluntary motorcycle insurance in Thailand is optional insurance, not required by Thai law. Depending on the coverage type, it may cover damage to the insured vehicle whether the driver is at fault or not, damage to third party vehicle if the driver of the insured vehicle is at fault, liability for injuries resulting from a motorcycle accident where the driver is at fault, loss of or damage to the vehicle through theft, fire or natural disaster. Voluntary motorcycle insurance is divided into 5 categories as followings:

Type 1

Comprehensive Big Bike insurance, which covers damage to the insured vehicle regardless of fault in case of accident, fire, theft, or natural disaster as well as liability to third parties (property damage and bodily injury) when the driver is at fault.

www.roojai.com

www.roojai.com

Type 2

Covers damage to the insured vehicle only in case of fire and theft and covers liability to third parties (property damage and bodily injury) when the driver is at fault.

www.roojai.com

www.roojai.com

Type 2+

Covers damage to the insured vehicle regardless of fault provided another identified vehicle has been involved in the accident as well as damage caused by fire, theft, or flood. It also covers liability to third parties (property damage and bodily injury) when the driver is at fault.

www.roojai.com

www.roojai.com

Type 3

Only covers the liability to third parties (property damage and bodily injury) when the driver is at fault.

www.roojai.com

www.roojai.com

Type 3+

Covers damage to the insured vehicle regardless of fault, provided another identified vehicle has been involved in the accident. It also covers liability to third parties (property damage and bodily injury) when the driver is at fault.

www.roojai.com

www.roojai.com

Another insurance guideline

thethaiger.com

thethaiger.com

Working my way through the aftermath of the accident - insurance, bills and recovery.

Ooops done it again. A David Unk crash.

Time for a quick cuppa on the Khong it's a 16 kms meander upstream to 1 of my favorite coffee shops, Enjoy on the Mekong. Enjoy Coffee has a magical relaxing atmosphere, but it was a boiling hot day when I left Enjoy to gently meander home. An old rustic house with a magnificent tree on the...

The 3rd party bike insurance I had with Thai Sri covered me for 200,000 baht damages to the other vehicle.

Negotiations were completed today at the CK police station & Thai Sri has agreed to pay out. The final definitive cost has yet to be decide, but is hovering on 200,000 baht. Anymore than this and it is my bill.

So time for a bike insurance upgrade I thought.

With the most options & very competitve prices, the Roojai broker would seem to be the way to go.

Motorcycle Insurance in Thailand - Get a Quote in Minutes

Check your motorbike insurance quote online in just a few minutes. Enjoy competitive premiums, customisable coverage, and convenient online renewal.

Compulsory Motorcycle Insurance in Thailand

Compulsory Motorcycle Insurance, also known as “Por Ror Bor” is mandatory insurance required by law for all motor vehicles within Thailand. This is to provide insurance coverage for everyone affected by motorcycle accidents, regardless of whether the person is a driver, a passenger, or a pedestrian. In the cases that involve a loss of life or body parts or health damage including the deceased person’s heir will also be covered, in the case of death.

Basic Por Ror Bor Insurance coverage

If there is an accident, the driver can claim compensation if injured, but will not cover the motorcycle damage. The details are as followings:

Death, loss of vital organ, and permanent disability = up to ฿35,000

Medical expenses = up to ฿30,000

Coverage by which the driver is not at fault

Compensation can be claimed as following details:

Death and permanent disability = up to ฿300,000

Medical expenses = up to ฿80,000

Daily compensation = ฿200 per day (up to 20 days) up to ฿4,000

Loss of 2 body parts = ฿300,000 / loss of 1 body part = ฿250,000 / loss of a finger or more = ฿200,000

To upgrade, these are the options.

Voluntary Motorcycle Insurance

Voluntary motorcycle insurance in Thailand is optional insurance, not required by Thai law. Depending on the coverage type, it may cover damage to the insured vehicle whether the driver is at fault or not, damage to third party vehicle if the driver of the insured vehicle is at fault, liability for injuries resulting from a motorcycle accident where the driver is at fault, loss of or damage to the vehicle through theft, fire or natural disaster. Voluntary motorcycle insurance is divided into 5 categories as followings:

Type 1

Comprehensive Big Bike insurance, which covers damage to the insured vehicle regardless of fault in case of accident, fire, theft, or natural disaster as well as liability to third parties (property damage and bodily injury) when the driver is at fault.

Comprehensive Type 1 Motorcycle Insurance in Thailand | Roojai

Get extra protection with the best type 1 motorbike insurance in Thailand. Enjoy affordable quotes online for the most comprehensive coverage.

Type 2

Covers damage to the insured vehicle only in case of fire and theft and covers liability to third parties (property damage and bodily injury) when the driver is at fault.

Affordable Motorcycle Insurance Type 2 in Thailand | Roojai

Secure your ride with type 2 motorbike insurance. Benefit from cost-effective premiums, protection against third-party damage, theft & fire.

Type 2+

Covers damage to the insured vehicle regardless of fault provided another identified vehicle has been involved in the accident as well as damage caused by fire, theft, or flood. It also covers liability to third parties (property damage and bodily injury) when the driver is at fault.

Reliable Motorcycle Insurance Type 2+ in Thailand | Roojai

Protect your ride with type 2+ motorbike insurance. Enjoy affordable premiums & reliable coverage, including protection against theft & third-party damage.

Type 3

Only covers the liability to third parties (property damage and bodily injury) when the driver is at fault.

Motorcycle Insurance Type 3 | Roojai.com Car Insurance Online

Check your big rbike insurance quote now! Type 3 comprehensive motorcycle insurance in Thailand. Insurance coverage for 3rd party liability, personal accident & more

Type 3+

Covers damage to the insured vehicle regardless of fault, provided another identified vehicle has been involved in the accident. It also covers liability to third parties (property damage and bodily injury) when the driver is at fault.

Type 3+ Motorcycle Insurance | Affordable Cover for Riders

Find affordable type 3+ motorcycle insurance quotes with Roojai Insurance, ideal for motorcycle & big bike riders. Choose your repair shop nationwide.

Another insurance guideline

Article - Motorcycle Insurance in Thailand: A Complete Buying Guide

Learn more about everything you need to know about motorbike insurance in Thailand with our complete buying guide.

thethaiger.com

thethaiger.com

Last edited:

Like all insurance companies the details are in the fine print, I tried to insure my X-Max with Roojai a few years ago and they wouldn't insure, I see now they will.

And you find out how good they are after an incident.

I just did an online quote looking at the details of each option, unless you select manually the excess starts at 50k baht, they value my bike at 80k baht.........................my premium quoted started at 7100 baht, after increasing each option to max cover it went up over 10k baht, so still self insuring atm.

BTW my Honda NC750X is insured with Roojai, has been for a few years, I just renewed recently and I see they have halved the value of my bike, replacement value has been 350k baht for the last 2 years, this year it is valued at 175k, although the premium is similar as last year though.

Surprised Thailand dont seem to have a company like Shannons (Australia) where you can agree on value of your bike, and insure accessories, and they even replace motorcycle clothing if you have an accident and its damaged.

And you find out how good they are after an incident.

I just did an online quote looking at the details of each option, unless you select manually the excess starts at 50k baht, they value my bike at 80k baht.........................my premium quoted started at 7100 baht, after increasing each option to max cover it went up over 10k baht, so still self insuring atm.

BTW my Honda NC750X is insured with Roojai, has been for a few years, I just renewed recently and I see they have halved the value of my bike, replacement value has been 350k baht for the last 2 years, this year it is valued at 175k, although the premium is similar as last year though.

Surprised Thailand dont seem to have a company like Shannons (Australia) where you can agree on value of your bike, and insure accessories, and they even replace motorcycle clothing if you have an accident and its damaged.

Roojai have undervalued My AT on the second year renewal. Makes no sense. A lesser model has more value.

I found Mr Prakan Brokers better and will go with them next time. You can also speak to a Person. Via Email rather than doing it all online.

Yes Mr Prakarn was great a couple of years ago too.

It must be time to back & visit their site also.

Mister Prakan Your 1-stop Shop For Everything Insurance!

Compare and Save on your insurance policies with us.

Check every insurance deal, check now at CheckDi

Compare and Save on Insurance with CheckDi

August - September 2022.

It is renewal time for the GTR Group Health Insurance folks.

All members - there are 13 members currently, 7 guys below 60 years & 6 above 60 years, should have had an email from Andy or Mon @ CnxInsure.

cnxinsure.com

cnxinsure.com

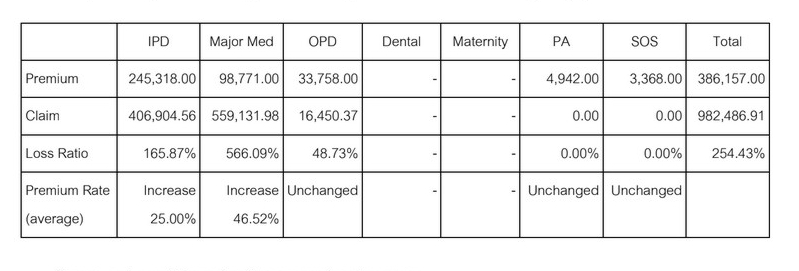

The GTR insurance company - Thai Health - took a hit last year with claims of 982,486.91 baht.

I put my hand up for most of this due to my accident in June.

www.gt-rider.com

Sadly the insurance company was not impressed & has increased the premium by "25%."

www.gt-rider.com

Sadly the insurance company was not impressed & has increased the premium by "25%."

My premium for plan 6, no OP, has jumped from 36,596 baht to 47,804 baht.

Some of you will be alarmed by this, rightly so & myself included.

For the guys under 60, who can easily change policies. you may want to consider any options offered by Cnx Insure our broker.

It is not compulsory to stay in the GTR Group Insurance.

We started this group policy off in 2008, 14 years ago & it was a good value for money policy at the time.

In the very first year, after only 6 months one of our members, Tropical John, TJ Hamilton, got a tumour & died.

To their credit the insurance company paid out the maximum 600,000 baht, for TJ's treament; but the next year there was a small premium increase, maybe 10-15% from memory.

Now however, as time goes by hospital costs have skyrocketed, our ages have increased & more claims have come in, the insurance company likes to keep their profit margin up. Covid-19 payouts may have also seriously affected insurance companies; profitability.

With this last premium increase, there maybe better options than the GTR Group Policy for some people now.

One of the crucial insurance issues is to secure a policy before you are 60 & try to keep it, getting insurance once you are past 70 is difficult & bloody expensive.

Another issue you may face is if you've had medical treatment & claims in the GTR Group policy, these become pre-existing conditions that you should not be covered for in a new policy. Personally I've had multiple skin cancer & kidney stone treatments that may not be covered anymore should I move!

For aging 70+ guys, Thai Health have previously offered GTR members a direct move across to their Wealthy Healthy policy

www.thaihealth.co.th

but as to be expected the premiums get right up there.

www.thaihealth.co.th

but as to be expected the premiums get right up there.

Good luck everyone out there.

Make your decision on whatever is affordable, & best for you.

I personally will be renewing my GTR Group Health Insurance policy, because @ 68 (69 in December), there aint many affordable places to go!

It is renewal time for the GTR Group Health Insurance folks.

All members - there are 13 members currently, 7 guys below 60 years & 6 above 60 years, should have had an email from Andy or Mon @ CnxInsure.

CNX Insure - Chiang Mai's No.1 Expat Insurance Service

Expat insurance services - including Health/Medical, Covid, Home, Car, Motorbike, Travel, and Personal Accident insurance.

The GTR insurance company - Thai Health - took a hit last year with claims of 982,486.91 baht.

I put my hand up for most of this due to my accident in June.

Ooops done it again. A David Unk crash.

Time for a quick cuppa on the Khong it's a 16 kms meander upstream to 1 of my favorite coffee shops, Enjoy on the Mekong. Enjoy Coffee has a magical relaxing atmosphere, but it was a boiling hot day when I left Enjoy to gently meander home. An old rustic house with a magnificent tree on the...

My premium for plan 6, no OP, has jumped from 36,596 baht to 47,804 baht.

Some of you will be alarmed by this, rightly so & myself included.

For the guys under 60, who can easily change policies. you may want to consider any options offered by Cnx Insure our broker.

It is not compulsory to stay in the GTR Group Insurance.

We started this group policy off in 2008, 14 years ago & it was a good value for money policy at the time.

In the very first year, after only 6 months one of our members, Tropical John, TJ Hamilton, got a tumour & died.

To their credit the insurance company paid out the maximum 600,000 baht, for TJ's treament; but the next year there was a small premium increase, maybe 10-15% from memory.

Now however, as time goes by hospital costs have skyrocketed, our ages have increased & more claims have come in, the insurance company likes to keep their profit margin up. Covid-19 payouts may have also seriously affected insurance companies; profitability.

With this last premium increase, there maybe better options than the GTR Group Policy for some people now.

One of the crucial insurance issues is to secure a policy before you are 60 & try to keep it, getting insurance once you are past 70 is difficult & bloody expensive.

Another issue you may face is if you've had medical treatment & claims in the GTR Group policy, these become pre-existing conditions that you should not be covered for in a new policy. Personally I've had multiple skin cancer & kidney stone treatments that may not be covered anymore should I move!

For aging 70+ guys, Thai Health have previously offered GTR members a direct move across to their Wealthy Healthy policy

Wealthy Healthy - Thai Health Insurance

In-Patient Coverage (IPD), Wealthy Healthy In-Patient Coverage is a patient who needed to be admitted as an inpatient in a hospital or in a medical facility for a minimum of 6 hours, and is registered as an inpatient under the advice of a licensed physician according to the standard medical...

Good luck everyone out there.

Make your decision on whatever is affordable, & best for you.

I personally will be renewing my GTR Group Health Insurance policy, because @ 68 (69 in December), there aint many affordable places to go!

Last edited:

Thanks so much for this tread.August - September 2022.

It is renewal time for the GTR Group Health Insurance folks.

All members - there are 13 members currently, 7 guys below 60 years & 6 above 60 years, should have had an email from Andy or Mon @ CnxInsure.

CNX Insure - Chiang Mai's No.1 Expat Insurance Service

Expat insurance services - including Health/Medical, Covid, Home, Car, Motorbike, Travel, and Personal Accident insurance.cnxinsure.com

The GTR insurance company - Thai Health - took a hit last year with claims of 982,486.91 baht.

View attachment 149277

I put my hand up for most of this due to my accident in June.

Sadly the insurance company was not impressed & has increased the premium by "25%."Ooops done it again. A David Unk crash.

Time for a quick cuppa on the Khong it's a 16 kms meander upstream to 1 of my favorite coffee shops, Enjoy on the Mekong. Enjoy Coffee has a magical relaxing atmosphere, but it was a boiling hot day when I left Enjoy to gently meander home. An old rustic house with a magnificent tree on the...www.gt-rider.com

My premium for plan 6, no OP, has jumped from 36,596 baht to 47,804 baht.

Some of you will be alarmed by this, rightly so & myself included.

For the guys under 60, who can easily change policies. you may want to consider any options offered by Cnx Insure our broker.

It is not compulsory to stay in the GTR Group Insurance.

We started this group policy off in 2008, 14 years ago & it was a good value for money policy at the time.

In the very first year, after only 6 months one of our members, Tropical John, TJ Hamilton, got a tumour & died.

To their credit the insurance company paid out the maximum 600,000 baht, for TJ's treament; but the next year there was a small premium increase, maybe 10-15% from memory.

Now however, as time goes by hospital costs have skyrocketed, our ages have increased & more claims have come in, the insurance company likes to keep their profit margin up. Covid-19 payouts may have also seriously affected insurance companies; profitability.

With this last premium increase, there maybe better options than the GTR Group Policy for some people now.

One of the crucial insurance issues is to secure a policy before you are 60 & try to keep it, getting insurance once you are past 70 is difficult & bloody expensive.

Another issue you may face is if you've had medical treatment & claims in the GTR Group policy, these become pre-existing conditions that you should not be covered for in a new policy. Personally I've had multiple skin cancer & kidney stone treatments that may not be covered anymore should I move!

For aging 70+ guys, Thai Health have previously offered GTR members a direct move across to their Wealthy Healthy policy

but as to be expected the premiums get right up there.Wealthy Healthy - Thai Health Insurance

In-Patient Coverage (IPD), Wealthy Healthy In-Patient Coverage is a patient who needed to be admitted as an inpatient in a hospital or in a medical facility for a minimum of 6 hours, and is registered as an inpatient under the advice of a licensed physician according to the standard medical...www.thaihealth.co.th

Good luck everyone out there.

Make your decision on whatever is affordable, & best for you.

I personally will be renewing my GTR Group Health Insurance policy, because @ 68 (69 in December), there aint many affordable places to go!

Mr. Prakan is known with me, a group insurance covering motorcycling ; this option not.

I'm nearly 60 in a couple of months. Pre-existing conditions. Hard to get proper insurance.

Are there any recent experiences with Insurance companies who did pay out properly as promised?

Purchasing insurance is most of the time easily done, but when you really need the umbrella.... what's happening then are my thoughts.

What are yours recommendation at this moment?

Kind Regards,

Ro El.

Thanks so much for this tread.

Mr. Prakan is known with me, a group insurance covering motorcycling ; this option not.

I'm nearly 60 in a couple of months. Pre-existing conditions. Hard to get proper insurance.

Are there any recent experiences with Insurance companies who did pay out properly as promised?

Purchasing insurance is most of the time easily done, but when you really need the umbrella.... what's happening then are my thoughts.

What are yours recommendation at this moment?

Kind Regards,

Ro El.

Get in before 60 mate otherwise it is tough & prohibitive.

Re paying out, Thai Health has been excellent with GTR so far & I personally have no complaints.

They took a hit in the first year when TJ died of cancer, plus have taken a couple of hits off me & a few other guys, but no one has ever complained they don't pay. Present your card at the hospital & they pay 90% direct.

The main issue nowadays is the skyrocketing costs of hospital treatment & the associated high premiums you end up with once you get over 65/70.

The Thai Health one is a cheap value for money insurance, but they have not increased their coverage in the 14 years we have had the policy. So there maybe better options nowadays, but you're going to pay for it. The choice is yours, but something is better than nothing.

Andy & Mon @ Cnxinsure do have a first class health insurance policy, but you pay for it, & personally it is more than I can afford now.

Fingers crossed we peacefully die of old age in our sleep.

Last edited:

Thanks,

Actually I'd give up already, so any new light at the end of the tunnel is something...

At the moment I do not have much more then a American Express Platinum Card. It is not nothing.

Do someone have experiences with just a American Express Platinum Card. Do they pay hospital bills in Thailand?

I'll give it a try with Andy and Mon @CNXinsure.

My goal is to get covered for the worst scenario.

Or let me put it in these words.

in a case of a serious event, a card which will open the door of a Hospital and let me go afterwards is very whishfull.

Is there anyone who is interested in the results I'll get?

I thought I was the only f... who decide to live in Thailand and leave the security of my homeland..

Actually, that National security comes now with long long waiting lists and no free choices of which hospital or doctor is going to treat you.

So, in my point of view. Everything comes with a price tag. But mandatory paying a lot of taxes and related costs for the so-called National Security

aka 'Father State will pay everything' is also not that quality anymore in my country.

So, Thailand becomes more and more expensive, yes. But the quality is also going up to higher standards and still with the Thai Hospitality!

So, let me know when anybody want to hear the results.

Actually I'd give up already, so any new light at the end of the tunnel is something...

At the moment I do not have much more then a American Express Platinum Card. It is not nothing.

Do someone have experiences with just a American Express Platinum Card. Do they pay hospital bills in Thailand?

I'll give it a try with Andy and Mon @CNXinsure.

My goal is to get covered for the worst scenario.

Or let me put it in these words.

in a case of a serious event, a card which will open the door of a Hospital and let me go afterwards is very whishfull.

Is there anyone who is interested in the results I'll get?

I thought I was the only f... who decide to live in Thailand and leave the security of my homeland..

Actually, that National security comes now with long long waiting lists and no free choices of which hospital or doctor is going to treat you.

So, in my point of view. Everything comes with a price tag. But mandatory paying a lot of taxes and related costs for the so-called National Security

aka 'Father State will pay everything' is also not that quality anymore in my country.

So, Thailand becomes more and more expensive, yes. But the quality is also going up to higher standards and still with the Thai Hospitality!

So, let me know when anybody want to hear the results.

Thanks,

Actually I'd give up already, so any new light at the end of the tunnel is something...

At the moment I do not have much more then a American Express Platinum Card. It is not nothing.

Do someone have experiences with just a American Express Platinum Card. Do they pay hospital bills in Thailand?

I'll give it a try with Andy and Mon @CNXinsure.

My goal is to get covered for the worst scenario.

Or let me put it in these words.

in a case of a serious event, a card which will open the door of a Hospital and let me go afterwards is very whishfull.

Is there anyone who is interested in the results I'll get?

I thought I was the only f... who decide to live in Thailand and leave the security of my homeland..

Actually, that National security comes now with long long waiting lists and no free choices of which hospital or doctor is going to treat you.

So, in my point of view. Everything comes with a price tag. But mandatory paying a lot of taxes and related costs for the so-called National Security

aka 'Father State will pay everything' is also not that quality anymore in my country.

So, Thailand becomes more and more expensive, yes. But the quality is also going up to higher standards and still with the Thai Hospitality!

So, let me know when anybody want to hear the results.

You could join the GTR one before 60 & stay in for awhile.

Once you hit the age limit, Thai Health will let your transfer straight over to one of their

Wealthy Healthy Policies.

Wealthy Healthy - Thai Health Insurance

In-Patient Coverage (IPD), Wealthy Healthy In-Patient Coverage is a patient who needed to be admitted as an inpatient in a hospital or in a medical facility for a minimum of 6 hours, and is registered as an inpatient under the advice of a licensed physician according to the standard medical...

Which you can stay in until 85, with premiums from 46,878 - 256,661 baht a year.

Re your American Express Platinum Card, I would think it is acceptable by the hospital, as they would check first if it is valid & works.

Update Increased Coverage @ a Price.

After putting the pressure on Thai Health there is an option for higher coverage now with 2 more plans. Plan 7 & Plan 8.

The coverage offered is maximum 2.4 million baht a year for IN Patient only or IN & OUT Patient.

The premiums are

94,964 baht Inpatient only

103,403 baht In & Outpatient

EH12000 is here

www.thaihealth.co.th

www.thaihealth.co.th

For more info please contact [email protected].

I will renewing with Plan 6, no OP, @ 47,804 baht..

After putting the pressure on Thai Health there is an option for higher coverage now with 2 more plans. Plan 7 & Plan 8.

The coverage offered is maximum 2.4 million baht a year for IN Patient only or IN & OUT Patient.

The premiums are

94,964 baht Inpatient only

103,403 baht In & Outpatient

EH12000 is here

Employee Healthy - Thai Health Insurance

Group health insurance Our insurance plans provide you with great value coverage for both the sum insured and the health insurance. Get the insurance out of your worries having to undergo a major surgery that costs excessively. ความคุ้มครองเบี้ยประกันภัยต่อคน Remark Standard premium for each age...

For more info please contact [email protected].

I will renewing with Plan 6, no OP, @ 47,804 baht..

Hi. New member, first post, glad to be here!

I've read some of the posts here on insurance but would like to ask for any updated info you may have.

My wife and I, 68/72, will be living in CM part-time as of mid-2023. We will own a new motorbike and plan to do lots of road trips! I'm an experienced rider and pretty conservative as riding goes...

1. Is "part-time" bike insurance feasible? Or, is it strictly bought on an annual basis?

2. Do you have recommendations where to begin asking for quotes? And more importantly, who has been honest to deal with?

We can afford insurance, but still do have a modest budget.

Thanks! Dave J.

I've read some of the posts here on insurance but would like to ask for any updated info you may have.

My wife and I, 68/72, will be living in CM part-time as of mid-2023. We will own a new motorbike and plan to do lots of road trips! I'm an experienced rider and pretty conservative as riding goes...

1. Is "part-time" bike insurance feasible? Or, is it strictly bought on an annual basis?

2. Do you have recommendations where to begin asking for quotes? And more importantly, who has been honest to deal with?

We can afford insurance, but still do have a modest budget.

Thanks! Dave J.

Last edited:

Hi. New member, first post, glad to be here!

I've read some of the posts here on insurance but would like to ask for any updated info you may have.

My wife and I, 68/72, will be living in CM part-time as of mid-2023. We will own a new motorbike and plan to do lots of road trips! I'm an experienced rider and pretty conservative as riding goes...

1. Is "part-time" bike insurance feasible? Or, is it strictly bought on an annual basis?

2. Do you have recommendations where to begin asking for quotes? And more importantly, who has been honest to deal with?

We can afford insurance, but still do have a modest budget.

Thanks! Dave J.

Hi Dave

Gday & welcome to GTR.

I just renewed my bike insurance via Mon.

[email protected]

The cost was 2700 baht a year.

The GTR Group Health Insurance we have is also via Mon.

She speaks good English & is able to answer all your questions promptly.

See also my recent accident report & how the insurance worked out,

Ooops done it again. A David Unk crash.

Time for a quick cuppa on the Khong it's a 16 kms meander upstream to 1 of my favorite coffee shops, Enjoy on the Mekong. Enjoy Coffee has a magical relaxing atmosphere, but it was a boiling hot day when I left Enjoy to gently meander home. An old rustic house with a magnificent tree on the...